Living in New York City is a dream of many people.

As a matter of fact, the city expects 64.5 million visitors in 2024, with an 81% domestic and 19% international split.

However, before moving to the Big Apple, it’s crucial to understand the true cost of living in NYC.

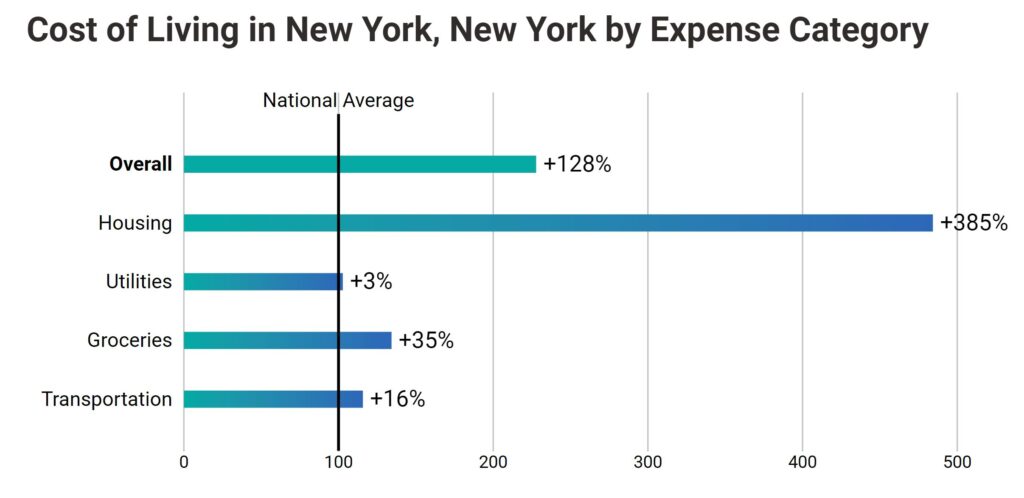

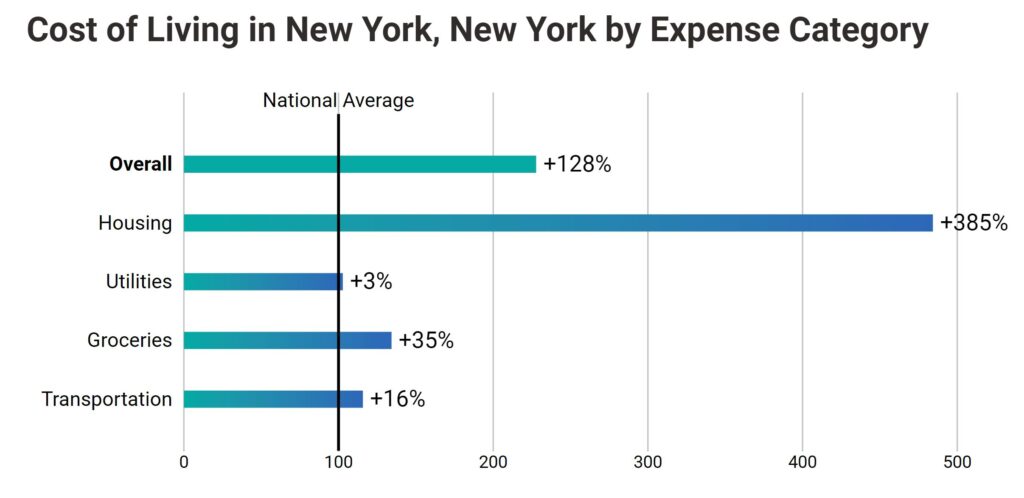

The fact that New York City has high living costs is not a secret. The costs far surpass the national average.

I based the costs in this article on my beliefs and experience. They may vary based on your preferences.

You will meet some NYC living costs in the article, including:

- Housing prices;

- Utilities and transportation expenses;

- Food and glossary expenses;

- Healthcare expenses overview;

- Fitness + Entertainment costs;

- How much money you need to live in NYC (as a single person).

By the end of this article, you will understand the cost of living in NYC. You will be able to compare it to your expectations.

Let’s start with the price of the housing in New York City.

You may also like: 15 Most Dangerous Neighborhoods in NYC

So What’s the Price of Housing in NYC?

One of the most significant expenses for New Yorkers is housing. The exorbitant housing prices heavily influence the cost of living in NYC in the city.

According to one of the studies, housing expenses in New York are a staggering 385% higher than the national average (see the graph below).

Overall, the median home price in NYC is over $2,180,000, making it one of the most expensive real estate markets in the country.

Renting is also costly, with the median rent in NYC reaching more than $6,600 per month.

When searching for a place to live in NYC, I would definitely recommend considering the location and neighborhood. It happens that I’ve seen the apartment but after visiting the place, turned out that the neighborhood wasn’t a proper one for raising kids.

On the other hand, Manhattan is known for its high-end luxury apartments. So some of the properties often exceed even $1 million for a one-bedroom unit.

Other boroughs – Brooklyn, Queens, the Bronx, and Staten Island offer more affordable options. But prices are still significantly higher than the national average. It’s crucial to factor in your budget and prioritize your housing needs before making a decision.

If you’re looking for affordable, low-income, shared housing, or other types of housing options, I would recommend you check this website (from NYC.gov).

You may also like: 25 Places to Find the Best Sublets in Williamsburg, Brooklyn

Utilities and Transportation Expenses in NYC

In addition to housing, utilities, and transportation also contribute to the high cost of living in NYC.

Overall, the utility prices in the city are 3% higher than the national average. The average energy bill for a 915-square-foot apartment is about $183 per month. The phone bill is about $196 per month.

Gas prices are also higher than the national average, with New Yorkers paying an average of about $4 per gallon.

Transportation costs in NYC can add up quickly. The city has a big public transportation system. It includes subways, buses, and trains. They offer convenient options for getting around.

However, fares can be expensive, with a single bus or subway ride costing $2.7. Monthly passes for unlimited rides on the Metropolitan Transportation Authority (MTA) cost about $130.

If you own a car in NYC, be prepared for high parking fees that range between $300-$900 per month in Manhattan.

On the other hand, for seniors over 65 years NYC Reduced-Fare MetroCards, with qualifying disabilities.

All in all, those approved for the program pay half the base fare when using MTA buses or subways. The Reduced-Fare MetroCard can be used all day on all MTA subways and local buses. It can also be used on express buses during non-rush hours.

The reduced fare for subways and local buses is $1.45, half the $2.90 base fare at all times of the day for eligible customers.

To get a Reduced-Fare MetroCard, submit a form and the needed documents to the Metropolitan Transportation Authority.

You may also like: NYC Public Transportation System: Overview & How It Works

The Cost of Food and Groceries

When it comes to food and groceries, the cost of living in NYC can take a toll on your budget.

In this case, grocery prices in the city are approximately 35% higher than the national average.

I’ll bring some examples of this.

Let’s take bread, milk, and eggs, for example. So the loaf of bread costs around $5.23, a gallon of milk is around $3.2, and a carton of eggs can set you back around $3.

On the other hand, fresh produce, such as a bunch of bananas, can cost around $4.53.

However, if you like dining out frequently, be prepared to spend more as the restaurants in New York City are not cheap.

You may also like: New York Food and Wine Festival

Healthcare Expenses in NYC

Healthcare costs in NYC are another factor. Consider them when calculating the cost of living.

Overall, healthcare expenses in the city are 8% higher than the national average.

For example, a doctor’s visit can cost around $135, while a dentist visit may set you back approximately $115.

In addition, optometrist visits average around $130. Prescription drugs can be quite expensive, with an average cost of around $500.

Another key point is the availability of health insurance options. Consider this when planning your budget in NYC.

Here’s a list of healthcare-related insurance options from NYC.gov that might be helpful for you:😉

- For Low-cost and free health insurance, check out Access NYC.

- For Free or very low-cost insurance for New Yorkers with low income, check out Medicaid.

- Child Health Assistance.

- Free or low-cost insurance for adults with low income (not qualifying for Medicaid), check out Essential Plan.

- For private help (with financial help available), check the Health Plans here.

- Discover the Family Planning Benefit Program here.

- Explore the Family Planning Extension Program here.

- For people who are 65 and older (with some disabilities), check this source.

- As for the working people (with their families) who want to temporarily continue the coverage they had through a job, they can check the “COBRA” program.

- Learn more about small business insurance suggestions here.

You may also like: Comprehensive Guide to 55-a Program

Fitness and Entertainment Costs

Staying fit and enjoying entertainment in NYC can come with a hefty price tag.

I have analyzed some gyms and fitness centers. The average cost of a gym membership in NYC ranges from $60 to $80 per month. This is much higher than the national average of $37.

So if you’re a fitness enthusiast, yes – you will find plenty of gyms, yoga studios, and fitness centers throughout the city.

But be prepared to pay a premium for these services.

As for entertainment, New York City offers a wide range of options, from Broadway shows to sporting events.

Lastly, the average ticket price for a Broadway show is around $80 to $200.

On the other hand, sports event tickets typically range from $30 to $40.

But if you’re a nightlife-lover, then get prepared to spend even more, I’ve provided some basic costs.

You may also like: 10 Best Things to Do Alone in NYC

Calculating Your Average Monthly Expenses in NYC

To see the cost of living in NYC, let’s find the average monthly expenses for one person. You can see the infographic above, indicating all the costs in one picture.

Please note that these figures are estimates and can vary depending on individual preferences and lifestyle choices.

I’ve rounded up the prices:

- Housing (Rent): $6,600

- Utilities (Energy Bill, Phone Bill): $400

- Transportation (Monthly Pass): $130 (not counting parking costs)

- Food and Groceries: $400

- Healthcare: $115-$500

- Fitness: $60-$80

- Entertainment: $200

- Miscellaneous Expenses: $500

Based on these estimates, the total average monthly expenses in NYC for a single person would amount to approximately $8,600.

But keep in mind that these figures are subject to personal variations and lifestyle choices. It’s crucial to create a budget that aligns with your specific needs and financial situation.

Cost of Living in NYC vs Other Areas in New York State

New York City is famous for its high living costs.

But, it’s important to note that living costs in other parts of New York State can be much lower.

Take Upstate New York, for example. It generally has a lower cost of living compared to NYC. Housing prices, utilities, and transportation are cheaper upstate. Even groceries tend to be, too.

However, it’s important to consider the trade-offs. These are in terms of job opportunities, amenities, and access to cultural attractions when comparing regions in New York State.

What’s the Recommended Salary for Living in NYC?

To comfortably afford the cost of living in NYC, it’s crucial to have a sufficient income.

Based on my experience, I can say that NYC salaries can vary a lot. They vary based on the job, industry, and experience level. I would recommend aiming for a salary that is at least 2.5 to 3 times the cost of housing.

Here’s an example. If your monthly rent is $6,500, it would be ideal to have a monthly income of $17,000 to $20,000. This will be a secure option in case of other expenses and allows for savings.

You may also like: 15 Best New York Business Ideas

Exploring Career Opportunities in NYC

Despite the high cost of living, New York City offers different career opportunities across various industries. Don’t forget that this is New York – one of the biggest metropolises in the world.

And it actually doesn’t matter what professional you are – the city has opportunities for everyone.

As for the salaries, I have to say in NYC salaries tend to be higher than the national average, but the living expenses, as mentioned before, are higher as well.

I would recommend you use these five job portals, when seeking a job in New York City (as they’re trusted and people use them most here):

You may also like: Manhattan Zip Code Map, From 10001 To 10282

Conclusion

Yes, living in New York City is quite expensive.

But I would say for many people (including me), the benefits outweigh the costs.

The average monthly cost of living in NYC is much higher than the national average. This is mainly due to housing, utilities, transportation, food, healthcare, and entertainment expenses.

But the salaries here are also higher than in other states.

So before moving to the Big Apple, carefully consider your budgeting options and prioritize your needs.

I hope the provided information above is helpful for you as now you have an overview of life in New York City.